Working remotely from abroad can be

a brilliant ‘financial’ move

Gain financial freedom with your own personalized international tax plan

Most people do not know that there are substantial financial benefits to living and working abroad.

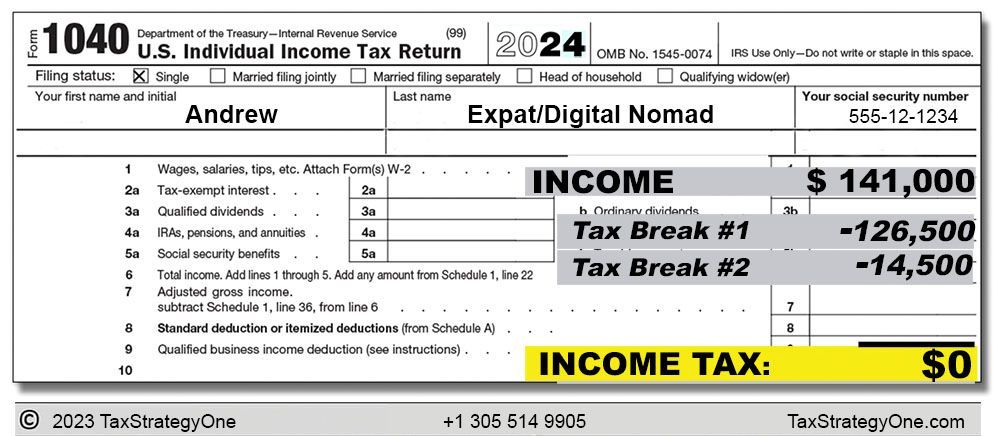

Tax-saving example #1

Single US Expat/Digital Nomad:

2024 Income: $141,000/yr.

Taxes: $0

FIRSTLY, DID YOU KNOW that the US tax code allows you to pay absolutely $0 US income tax on up to $141,000 (or more) every year when you ‘go international’?

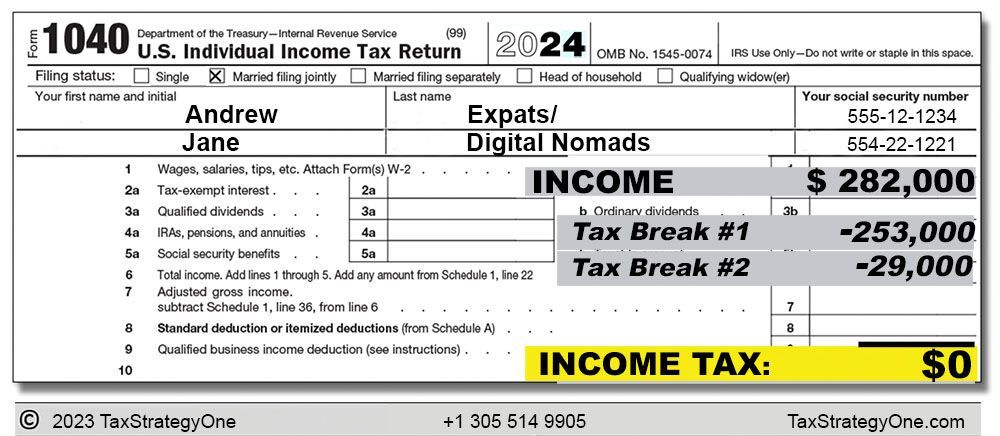

Tax-saving example #2

Married Expats/Digital Nomads:

2024 income: $282,000/yr.

Taxes: $0

And if both you and your spouse qualify, you can double the tax-free ‘joy’ to $282,000 (2 x $141,000) or more every year and not owe Uncle Sam a nickel ($0 in taxes):

Plan Well

Live Well

Grow Faster

Prosper

TAX PLANS WITH IMPACT

Case Study: Andrew

Two years ago, Andrew was 'Income Rich but Cash Poor' when he lived in the U.S. High taxes and the high cost of living in the U.S. left him little for savings or investments back then.

Andrew’s life changed when he called us for a personalized tax-reduction plan. He calls it his “Plan B,” and our 'go international' tax plan provides him with an additional $100,000 of investable money every year—on the same base salary.

The easy way to start

1.

Make an appointment

2.

We'll assess your current situation, providing a solid baseline to work from.

3.

Well work with you to understand your goals so we can help you save in all the right areas.

4.

We’ll then show you many generous expat tax benefits that can dramatically lower your tax bills.

What People Say About Us

“Great tax plan. Great Savings!”

Andrew W.

“Amazing tax savings, presented in a clear, concise way!”

Robert K.

"Great Plan! - thank you. We've stopped overpaying our taxes.”

G.M., CFO

Contact us any time

Contact Us

We will get back to you as soon as possible

Please try again later

+1 305 514 9905 (Direct and WhatsApp)

Advisor@taxstrategyone.com

TaxStrategyOne.com

We help you navigate the complexities of US tax laws, as there are little-known IRS rules and reporting requirements when you ‘go international.’ You face penalties—sometimes quite hefty—as well as losing your beneficial tax-breaks for not complying with these little-known regulations. Do yourself a favor and get your own professional plan in place from our experienced international tax strategists.

Copyright Tax Strategy One 2018-2023